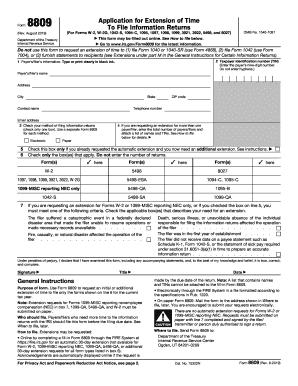

IRS 8809 2020-2025 free printable template

Show details

Send Form 8809 to Ogden UT 84201-0209 Need help If you have questions about Form 8809 call the IRS toll free at 866-455-7438 or 304-263-8700 not toll free. Socialsecurity. gov/employer. Cat. No. 10322N www.irs.gov/Form8809 Form 8809 Rev. 9-2017 Page 2 When to file. Exception. When filing Form 8027 on paper only attach a copy of your timely filed Form 8809. Extension period. File Form 8809 as soon as you know an extension of time to file is necessary but not before January 1 of the filing...

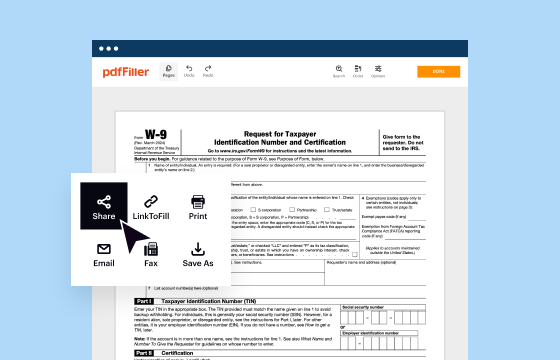

pdfFiller is not affiliated with IRS

Understanding and Effectively Utilizing IRS Form 8809

Detailed Instructions for Editing IRS Form 8809

Completing the IRS Form 8809: A Step-by-Step Guide

Understanding and Effectively Utilizing IRS Form 8809

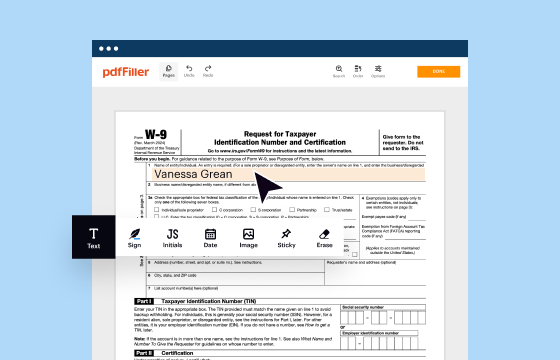

IRS Form 8809, officially known as the "Application for Extension of Time to File Information Returns," is an essential document for taxpayers and businesses required to file information returns such as Forms 1099 or W-2. This form allows filers to request an extension to submit necessary information returns, ensuring compliance and avoiding penalties. Understanding how to complete this form can prevent unnecessary stress and potential fines.

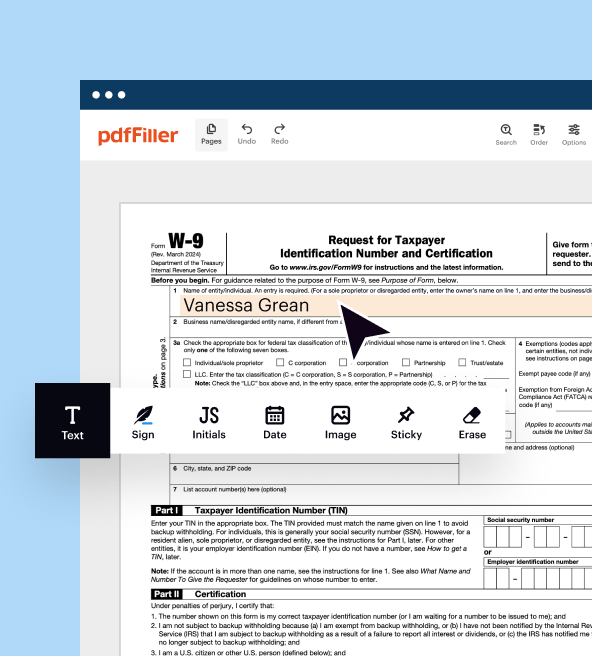

Detailed Instructions for Editing IRS Form 8809

To make edits to IRS Form 8809, follow these steps:

01

Download the latest version of Form 8809 from the IRS website.

02

Open the form in a PDF editor to allow for modifications.

03

Review the sections for any changes needed, such as contact information or filing details.

04

After making your edits, double-check for accuracy. Ensure all entries are complete and consistent.

05

Save the updated form and prepare for submission by the filing deadline.

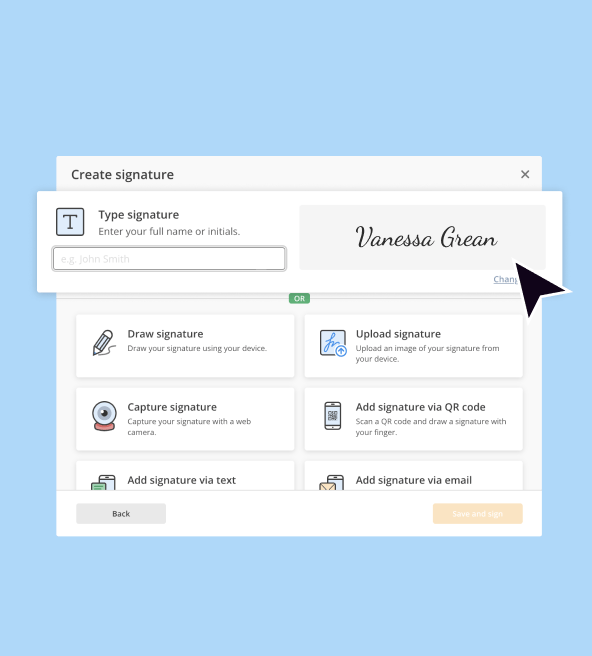

Completing the IRS Form 8809: A Step-by-Step Guide

Completing IRS Form 8809 involves several key steps:

01

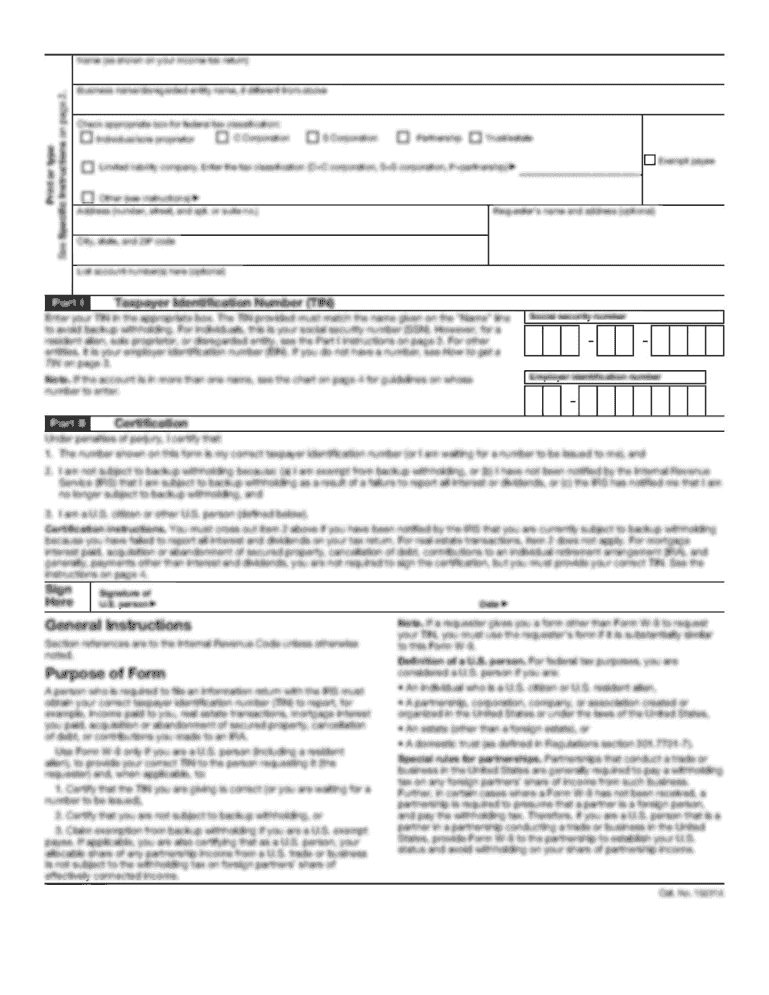

Begin by filling out identifying information, including the name and taxpayer identification number (TIN).

02

Specify the type of information returns for which you are seeking an extension.

03

Determine the requested extension period, noting the maximum extension allowed is typically 30 days.

04

Sign and date the form to certify that all information is accurate and complete.

05

Submit the form electronically or via mail to the appropriate IRS office by the prescribed deadline.

Show more

Show less

Recent Changes and Updates to IRS Form 8809

Recent Changes and Updates to IRS Form 8809

Recent adjustments to IRS Form 8809 reflect new IRS regulations that affect reporting requirements. For instance, in 2023, updates included revised guidelines for electronic filing and extending deadlines for certain types of information returns. Tax professionals and filers should review the IRS announcements regarding these changes to ensure compliance.

Essential Insights Regarding IRS Form 8809

What Exactly is IRS Form 8809?

The Primary Purpose of IRS Form 8809

Who Needs to Complete IRS Form 8809?

Conditions for Application of Exemptions

Components of IRS Form 8809 You Should Know

Filing Deadlines for IRS Form 8809

Comparative Analysis: IRS Form 8809 and Similar Forms

Transactions Covered by IRS Form 8809

Submission Requirements: Number of Copies Needed

Understanding Penalties for Non-Compliance with IRS Form 8809

Essential Information Required for Filing IRS Form 8809

Additional Forms That May Accompany IRS Form 8809

Where to Send IRS Form 8809

Essential Insights Regarding IRS Form 8809

What Exactly is IRS Form 8809?

IRS Form 8809 is an application that allows taxpayers to request an extension of time to file specific information returns. Typically, filers must submit this form when they need extra time for documents such as 1099 or W-2 forms. Using IRS Form 8809 effectively can help in mitigating the risk of penalties associated with late filings.

The Primary Purpose of IRS Form 8809

The primary purpose of Form 8809 is to provide taxpayers and entities the opportunity to apply for an extension beyond the original filing deadline for their information returns. By submitting this form, filers communicate their intention to the IRS, maintaining compliance while managing their filing timeline.

Who Needs to Complete IRS Form 8809?

IRS Form 8809 must be completed by any business or individual who needs to file information returns and cannot meet the existing deadlines. For example, a small business that issues Form 1099 to independent contractors may require additional time to compile accurate data, making Form 8809 essential for avoiding penalties.

Conditions for Application of Exemptions

Exemptions to IRS Form 8809 are applicable under specific conditions, including:

01

Filing fewer than 250 information returns, where the extended deadline does not apply.

02

Being classified as a tax-exempt organization, which may face different compliance requirements.

03

Situations where a payer has filed a previous extension and meets IRS criteria for an additional extension.

Components of IRS Form 8809 You Should Know

The key components of IRS Form 8809 are:

01

Taxpayer Identification Number (TIN)

02

Name and address of the payer

03

Types of returns for which an extension is being requested

04

Requested extension period

Filing Deadlines for IRS Form 8809

The deadline for submitting IRS Form 8809 generally aligns with the due date of the information returns being filed. For instance, if the original deadline for a W-2 form is January 31, the extension request should be submitted by this date. Extensions are typically granted for 30 days past the original deadline.

Comparative Analysis: IRS Form 8809 and Similar Forms

IRS Form 8809 can be compared to IRS Form 4868, which is the application for an automatic extension of time to file individual income tax returns. While both forms serve to extend deadlines, Form 8809 specifically targets information returns, whereas Form 4868 is aimed at personal tax filings.

Transactions Covered by IRS Form 8809

IRS Form 8809 is relevant for various transactions, including but not limited to:

01

Payments reported on Form 1099 for freelancers and contractors.

02

Employee compensation reported on Form W-2.

03

Other information return documents requiring statutory reporting.

Submission Requirements: Number of Copies Needed

Generally, only one copy of IRS Form 8809 is required for submission. Filers should ensure that the original is submitted to the IRS, while retaining copies for their records.

Understanding Penalties for Non-Compliance with IRS Form 8809

Failure to submit IRS Form 8809 or comply with information return deadlines can result in significant penalties. Common penalties include:

01

Failure-to-file penalties, which can range from $50 to $550 per form, depending on how late the forms are.

02

In cases of willful neglect, penalties can surge up to $1,100 per form.

03

Legal repercussions may also arise under certain circumstances involving fraud or severe neglect.

Essential Information Required for Filing IRS Form 8809

When filing IRS Form 8809, necessary information includes:

01

Your employee or payer TIN

02

Name of the business or entity

03

Contact information including address and phone number

04

Details regarding the types of information returns being filed

Additional Forms That May Accompany IRS Form 8809

While IRS Form 8809 is frequently filed independently, it may sometimes accompany other forms related to information returns, such as Forms 1099 or W-2, when addressing corrections or filing different types of reports simultaneously.

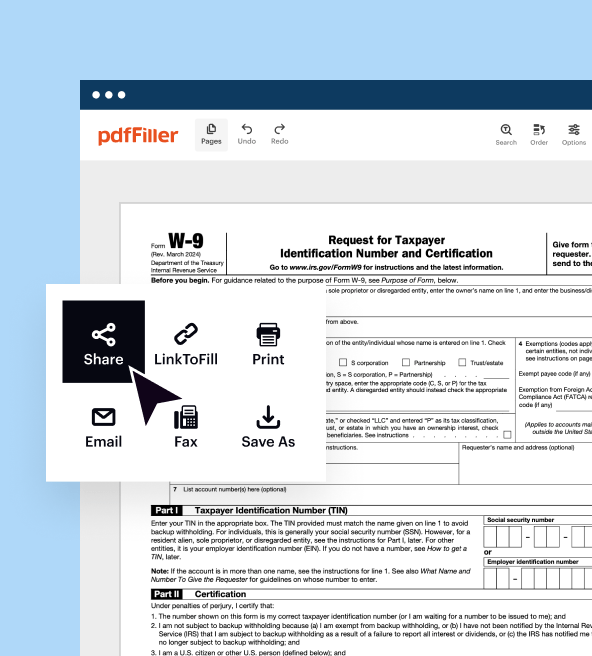

Where to Send IRS Form 8809

IRS Form 8809 should be sent to the address specified in the form instructions, which typically involves mailing to the specific IRS center designated for processing forms depending on the type of information returns being filed. Filers can also choose electronic submission via the IRS e-file system, where applicable.

Understanding IRS Form 8809 is imperative for ensuring compliance with tax regulations. Taking the time to complete this form accurately can save you from financial penalties and headaches down the road. If you have further questions or need assistance in preparing Form 8809, consider reaching out to a tax professional or using dedicated software to facilitate the process.

Show more

Show less

Try Risk Free